The Basic Principles Of Second Mortgage Vancouver

Table of ContentsThe Buzz on Foreclosure LoansThe Definitive Guide to Mortgages VancouverFacts About Mortgages Vancouver UncoveredEverything about Loans VancouverNot known Facts About Home Equity Loan VancouverThe Best Strategy To Use For Home Equity Loans VancouverThe Ultimate Guide To Home Equity Loan Vancouver

With house equity financings, you're needed to obtain the entire funding amount in a round figure, and also begin paying it off virtually right away. Individuals sometimes like HELOCs because they are much more versatile if you're unsure exactly how much cash you'll finish up requiring, but want the liberty to take advantage of your line of credit rating at any moment.if you know specifically how much you need to borrow as well as how the money will be used. When authorized, you're ensured that quantity, and also you get it completely. if you're not exactly sure how you'll require to borrow or when exactly you'll need it. It offers you access to cash for a collection time period.

A house equity lending (or bank loan) lets you borrow a round figure amount of money against the equity in your house on a set passion rate and with fixed monthly payments over a fixed term of between 5 as well as 20 years, similar to your first home mortgage other than with a shorter term.

Unknown Facts About Second Mortgage Vancouver

You can use the line of credit for any kind of significant acquisition and also attract the cash whenever you require it, enabling you to at first only pay passion on the cash you've drawn, instead of the full car loan quantity. Residence equity lendings are typically used to remodel because of the repaired regular monthly repayments, and low fixed rate of interest - nonetheless obtaining power is restricted by readily available home equity.

A Reno, Fi Renovation House Equity Loan incorporates the convenience and also framework of a standard home equity lending with the included loaning power of a building and construction funding. This model is a good alternative for lots of property owners, but it is necessary to examine all of your options prior to deciding what's ideal for you.

Maybe you've heard that, in many cases, you can subtract the interest paid on house equity finances or credit lines on your income tax return? Typically, the rate of interest on these car loans is tax-deductible when: Your financing is secured versus your residence - home equity loans Vancouver. This is used to perform significant enhancements that include value, prolongs its valuable life, or adapt it for a new usage.

Examine This Report on Home Equity Loans Vancouver

Have an inquiry - Conversation, Email, Call currently ... Wondering what to choose in between a residence equity car loan vs a home equity line of debt (HELOC)?, we do as much as we can to aid our clients make informed decisions in using their residence equity.

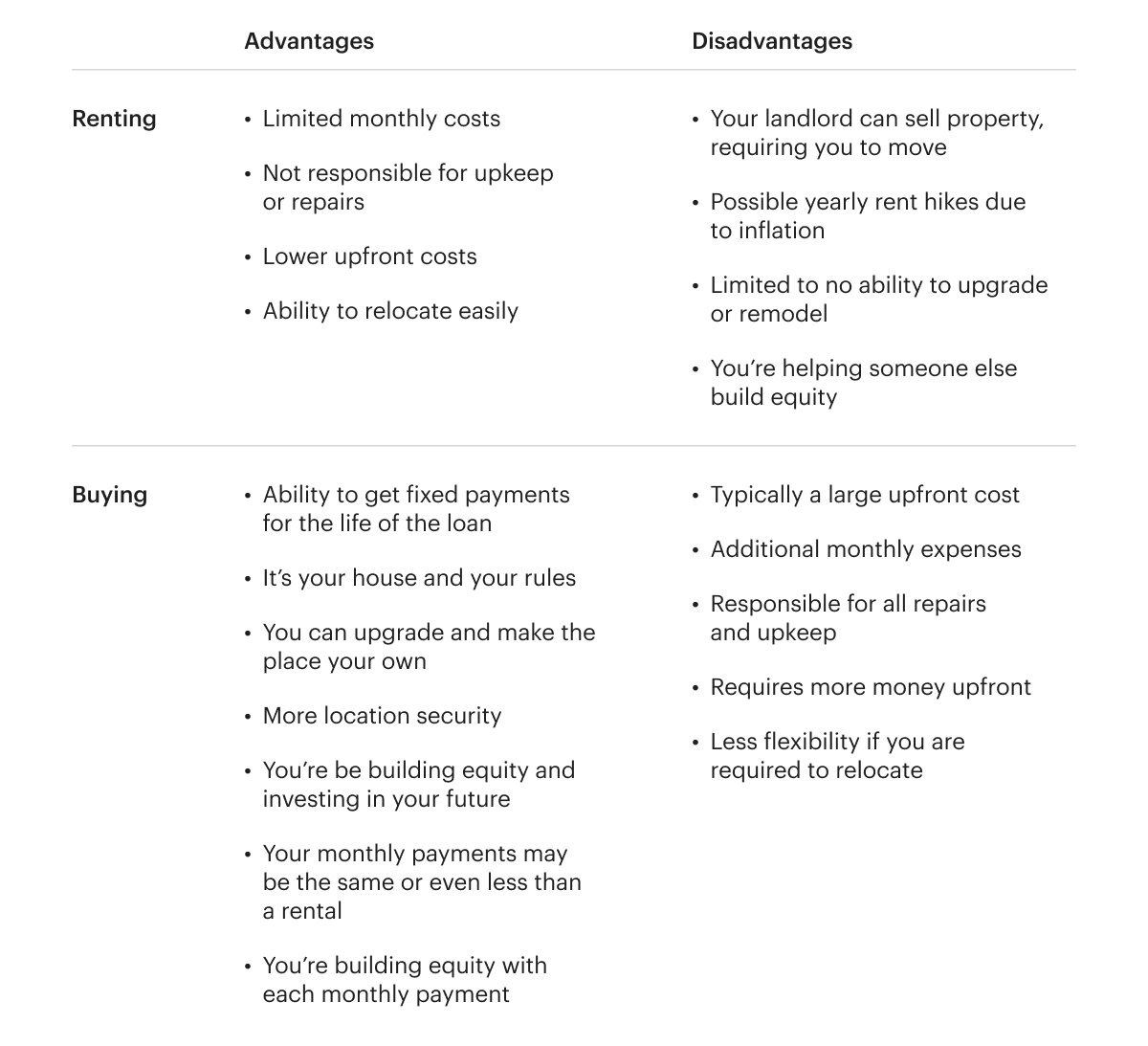

Which one is much better for you as well as your family? Choosing to borrow against the equity in your residence is not a decision to be ignored. The secret to recognizing which one to choose between a house equity funding vs a house equity credit line, is extensively recognizing the benefits and drawbacks each.

Indicators on Mortgages Vancouver You Should Know

With banks or cooperative credit union, the credit line you can obtain will certainly be typically limited by a funding to value as well as earnings ratio. With the exception of the evaluated value of your house, this proportion likewise thinks about your earnings circumstance, credit report or credit report record. And also as a result of the COVID-19 pandemic as well as the resulting financial shock, financial institutions' approvals are even harder.

When dealing with a trusted mortgage broker in BC, no other variables various other than just how much equity you have included residence issue. Our chosen personal loan providers in Vancouver have a lot of finance alternatives for everybody. Their solutions match any type of debtor's monetary situation, also the most complicated ones. And now for the very best part: some of our lending institutions will certainly not bill you a prepayment penalty in instance you wish to settle your finance ahead of timetable, like many banks typically do.

The tiniest month-to-month payments will cover the passion during the draw period. Yet since different loan providers have different offers, for some HELOCs you will certainly require to pay a huge round figure at the end. When comparing the differences between a residence equity lending as well as a residence equity credit line, this kind of loan has one major benefit: flexibility.

The 10-Minute Rule for Home Equity Loans Bc

Why not call us today and also we can review your circumstance detailed. We can make a decision with look here each other which product is much better matched for you between a home equity finance vs a home equity line of credit rating. We can additionally assist you towards the most effective lender with one of the most budget friendly terms.

Your equity will be reduced by the quantity of the financing, though your equity will certainly transform over time, as well as we will go right into that in even more information in this article. Some people think about home equity as being a method to safeguard financings, especially those that help make renovations to their residence, however there is a lot more to it than that.

You can compute it by taking the evaluated value of your house and after that deducting all car loans that are superior against it. These finances can consist of a home mortgage, house equity car loan and also home equity credit line. Let's state your residence has actually just been appraised at a worth of $800,000.

A Biased View of Foreclosure Loans

There are several advantages as well as drawbacks of reverse home mortgages, and one of the key reverse mortgage advantages can have an effect on your house equity. Home equity reverse mortgage consumers don't need to make any kind of mortgage repayments, and also this indicates that the amount they owe increases yearly (because of the yearly passion billed) - home equity loan Vancouver.

Your residence equity would be worth $300,000 today. You take advantage of the reverse mortgage advantages as well as make no routine home mortgage payments.

Everything about Mortgages Vancouver

If home values increase by 3% this year, your house would deserve $515,000 in a year's time (over the last 15 years, house worths in Canada increased by approximately 6. 4% each year). After a year, your house equity would certainly be: $515,000 $209,300 = Your residence equity would have raised by $5,700, also if you made no home loan or passion repayments.

Instead of obtain a reverse mortgage, they chose to sell their $500,000 residence in Ontario and also relocated into a $300,000 condominium. After paying real why not find out more estate agent charges, land transfer tax obligation on their brand-new residence, elimination prices and also lawful charges, they were entrusted to just over $160,000. They currently had actually the added expense of condo fees and also wound up spending their money after seven years.